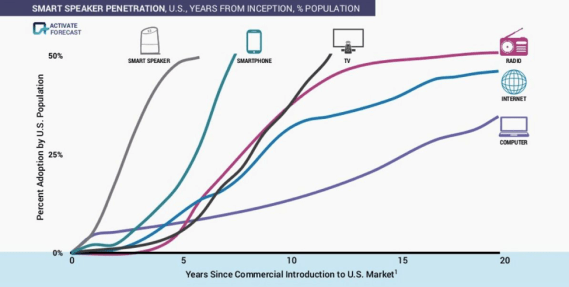

Smart speakers are very popular consumer electronic devices, and their penetration is not showing any signs of a slowdown.

According to the analysts at Canalys, almost 100 million smart speakers will make their way to homes all over the world by the end of 2018, more than double the number in place at the end of 2017. Given that these devices are connected to the Internet, enabling their users to access information and to order products and services, this is clearly a trend that marketing researchers and practitioners can’t ignore. We need to understand how consumers use smart speakers, and how the market is likely to evolve, so that we can prepare for the opportunities and threats presented by this technology.

From what I could gather, research on this topic is quite limited at the moment. The empirical work is mostly – though not exclusively – being done by practitioners and is focused on the USA. There are, also, a handful of conceptual papers. Here is an overview of the key messages emerging from those early writings.

Consumer behaviour

Edison Research published a report a few months ago, with some interesting insight about how US owners of smart speakers use this product. It is a really interesting report because it goes beyond adoption profiles to look at usage. It also seems to have followed a rigorous methodology. You can download the report and access a number of interesting videos here.

Edison Research’s report points to a very broad use of smart speakers, from listening to the news and getting traffic reports, to listening to music, ordering food, making phone calls, or even controlling home appliances like the lights or the TV. Around 50% of owners reported increased use of their devices now vs. when they first bought them – not just in terms of total number of hours, but also in terms of range of features used. That is, customers are satisfied with the product, and keep finding new ways in which it adds value to their lives. By this measure, smart speakers are not a fad.

Smart speakers are not only fitting easily into people’s lives, but even changing behaviours. For instance, smart speaker owners report consuming more news than before, and replacing reading with audio consumption. So, this isn’t just an important channel to consume certain products – it also changes what products are consumed.

Moreover, 56% of new owners of these devices also increased their usage of the voice assistants on their phones. That is, there are direct as well as indirect impacts on consumer behaviour.

The majority of smart speaker owners are so happy with their devices that they have encouraged their friends to get one, or have even gifted one themselves.

Finally, smart speakers are used by all age groups. And, according to Canalys, while English speaking countries are, currently, the dominant market, this is likely to change in the very near future.

Niraj Dawar, writing for Harvard Business Review, argues that consumers will trust smart speaker brands more than product brands, because they expect the recommendations from their smart speaker (e.g., on how to remove grass stains) to be unbiased and targeted to their preferences, whereas product brands will be trying to push their own products and will present them with too many, irrelevant choices.

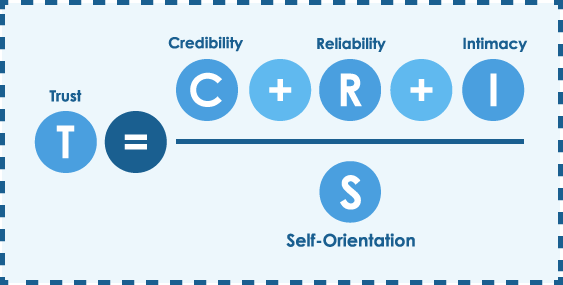

I can see how ease and convenience may drive use of smart speakers for product recommendations. However, for trust to happen (see equation below), smart speaker’s recommendations would also have to be credible and not self-fulfilling, which will not be the case for all brands of smart speakers, or even for all product lines. For instance, it is widely perceived that Amazon’s best-selling books’ lists can be easily gamed, and that the company favours the books that are published exclusively on their platform.

Early findings from research being done by Jason Pridmore and colleagues, at Eramus University Rotterdam, shows that smart speaker owners are very aware of the ethos of the companies behind them (E.g., Alexa / Amazon vs. Siri / Apple), and that some users adjust their behaviour as a result of these perceptions. So, the jury is out on whether consumers truly trust their smart speakers, or not.

The industry

At the moment, the market is dominated by Amazon and Google, with Apple a distant third place. Other players in this market include Sonos, Alibaba and Xiaomi.

There are very significant economies of scale and scope in this market. Economies of scale because of the heavy investments required to develop the product, and because of proprietary technology. Economies of scope because, as mentioned above in relation to Edison Research’s report, use of smart speakers in the home is reflected in increased use outside of the home, too.

Because of these factors on the one hand, and the current high levels of customers satisfaction and word of mouth on the other hand, it will be difficult for new, small players to enter the general-purpose smart speakers’ market. However, we may see some niche offerings, for instance, around enhanced privacy protection, or for very specific applications (like, health care).

Implications for marketing strategy and marketing management

The descriptions above point to some important changes in terms of what people consume and how, as well as how firms might interact with consumers.

The increase in consumption of information and entertainment products in audio format, means that content producers need to look into producing audio versions of their books, magazines, newsletters, blogs, etc… A good example of this is the BBC, which even produced a programme that is exclusively accessible via smart speakers.

The use of smart speakers for ordering products, making calls, etc… means that providers need to staff phone lines for those customers that want to order directly via the phone (as opposed to online or via an app), reversing the trend from the last few years. And for those customers that want the smart speakers to place orders on their behalf, firms need to invest in machine to machine interaction (infrastructure, menus, …) to offer that functionality.

With customers turning to their smart speakers to search for solutions to problems, these platforms will become powerful influencers of consumer choice. Dawar argues that smart speaker companies will be more powerful than large retailers, such as Walmart in the USA. Large retailers typically owe their competitive advantage to being able to offer customers plenty of choice and/or lower prices than competitors. However, these large retailers’ advantage disappears when competing with smart speakers, especially if the smart speaker is programmed to search for low cost alternatives and to filter the results according to the customer’s preferences.

Moreover, with consumers relying on smart speakers for recommendations, marketers have two options. They either invest in branding to ensure that customers ask for their product by name (e.g., I want Weetos), or they need to think about how to get their products recommended on the platforms, much like they currently do for search engine marketing or, for Amazon listings. For some, it is about having the lowest price. For others, about having the most or the best reviews.

They also need to need to work with the smart speaker providers. For instance, positioning themselves as partners through mutually beneficial innovation. One example is Tesco, which offers automated shopping solutions for all the leading smart speaker providers.

There will also be significant impacts for customer strategy. Dawar argues that smart speakers will improve the effectiveness of customer acquisition. This is because smart speakers make granular data available, in real time, about what the customer is looking for, and when. However, customer retention will be harder. This is because customer loyalty is often the result of customer inertia – that is, in certain product categories (e.g., fuel), consumers continue to purchase something out of habit and/or due to the absence of problems, rather than active, continued preference. So, the smart speakers, by actively suggesting replacements to the customer, will overcome the inertia that sustains repeated purchases in those product categories.

These are the key messages from the good quality research and writings that I could find, about smart speakers. Do let me know if you come across good research reports or papers in this area, please.

2 thoughts on “Smart speakers – consumer behaviour, industry structure, and implications for marketing”